Manhattan Associates Inc. releases findings from its 2024 Supply Chain Confidence Survey. Spanning 250 executives in retail, 250 in supply chain logistics, and 500 consumers, the survey measured their confidence and concerns for the upcoming holiday season. Conducted in September 2024, the survey revealed consumer worries over the inflated cost of gifts and the retail industry’s corresponding moves.

Shoppers are feeling economic pressures this holiday season, with 85% citing inflation and increased prices as a top concern. In response, nearly 61% of supply chain leaders reported having invested in new technologies and processes to run more efficiently and reduce overall costs this season.

“This is a unique holiday season in many respects, but retail and supply chain leaders seem prepared for the challenge and seem confident in their ability to meet consumer expectations,” says Ann Sung Ruckstuhl, SVP and chief marketing officer of Manhattan Associates. “The importance of an agile and nimble supply chain is evident, and deploying the right technology is more critical than ever before. The key to matching consumer expectations and giving shoppers the memorable experience they demand is to tighten the back end, have complete insight into every part of the product’s journey, and truly embrace a unified commerce approach in order to succeed.”

Key Takeaways:

- Both retailers and consumers are feeling the pressure of inflation. Approximately 70% of retailers are anticipating higher holiday costs, and nearly 85% of consumers cited increased prices as a top concern this holiday season. According to the Supply Chain Confidence Survey, 64% of consumers report having to reduce their spending on non-essential goods due to inflation. To further protect their wallets during the holiday season, 52% of consumers confirmed they will prioritize (and are willing to wait for) deals and discounts over every other shopping criterion this season.

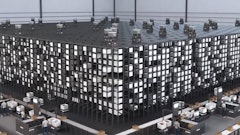

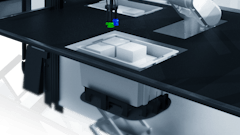

- Also feeling inflationary pressures, supply chain leaders and retailers are leveraging new technologies, streamlining operations, and implementing strategic measures to optimize operations and reduce costs. 61% of retailers reported recent investments in new technologies to improve the efficiency of their supply chains. With this increased efficiency, 44% of retailers plan to make fewer seasonal hires in stores this year. However, 58% of supply chain leaders plan to increase their workforce to manage peak omnichannel demand. More than a third of the retailers surveyed will be implementing the latest automation technologies to hedge against rising costs (35%) and manage last-minute order surges (42%).

- To mitigate the impact of inflation, nearly 70% of retailers said they will offer increased sales and discounts, 56% will offer discounts via their loyalty programs, and 34% will offer flexible payment options.

- Retailers are also applying the latest AI technologies to solve the problems listed above. 80% of retail and supply chain leaders see AI as a solution and are leveraging AI tools to improve inventory management, demand forecasting, and customer service this holiday season.

- Despite a general wariness about shipping reliability during the holiday season, nearly half (46%) of shoppers do not anticipate major delivery issues this year and only 34% expect some delays. Instead, the survey shows consumers have adjusted their priorities for cost-effective options over rapid delivery. While timely delivery certainly remains important, consumers care more about knowing the precise location and ETA of their orders over fastest delivery options. Despite their belt-tightening, retailers are confident of their ability to fulfill orders and respond to market changes. 92% of retail leaders feel assured in their fulfillment capabilities, and 87% of supply chain leaders are prepared for potential disruptions. 87% of retailers have also taken steps to keep shelves stocked with trending and high-demand products.

- With only 27 days between Thanksgiving and Christmas, this holiday shopping season is shorter than normal, prompting consumers to act quickly. The compressed timeframe means shoppers are avoiding the last-minute shopping spree. The Supply Chain Confidence Survey revealed that 40% of consumers are planning their shopping journeys earlier to spread out their holiday spending and they aren’t prioritizing instant gratification. Instead, their priority is free shipping with nearly 65% of consumers rating it as a top priority this holiday season.

- The survey revealed that the upcoming presidential election has a unique impact on holiday spending across different generations. Baby Boomers are twice as likely to spend less if their preferred candidate doesn’t win the election compared to Millennials. Additionally, concerns about post-election conflicts are driving consumers to move away from traditional shopping experiences with nearly 20% planning to reduce mall visits, with a preference for online shopping (22%) and crowd avoidance (25%) emerging as notable alternatives.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)